By buying stocks at prices well below their target, this discounted price builds in a margin of safety in case estimates are incorrect or biased.

Note: Margin of safety is a principle of investing in which investors only purchase assets with market prices significantly below their intrinsic value.

As a result, by the end of 2004, he was managing $600 million and turning investors away.

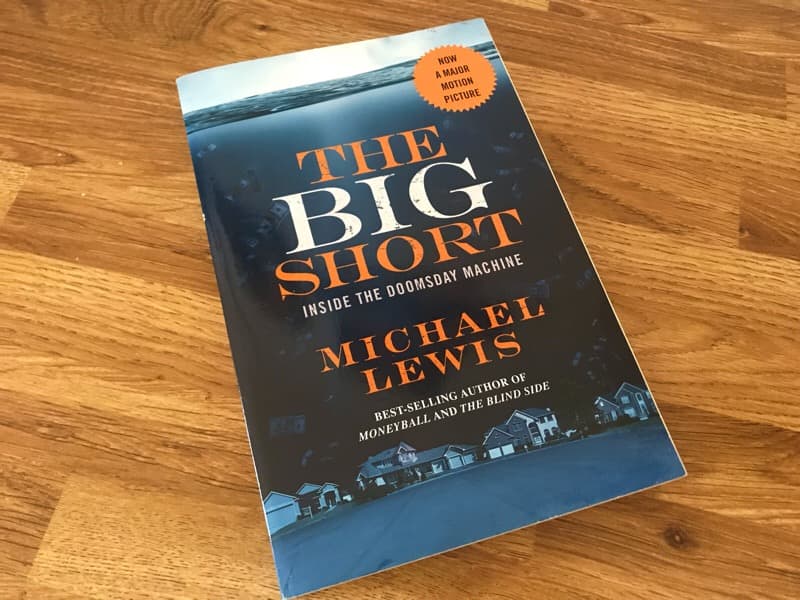

The market continued to decline dramatically over the next two years, yet Burry’s fund returned 16% (compared to the 22% fall of S&P 500) and 50% (S&P rose 28%), making him one of the most successful investors in the industry at the time.īurry was so successful that he attracted the interest of companies such as Vanguard, White Mountains Insurance Group, and well-known investors such as Joel Greenblatt. He began shorting those stocks immediately, quickly earning extraordinary profits for his investors.īurry returned 55% in the first year (2001) even though the S&P 500 fell almost 12%. ”Īccordingly, he was among the first to call the dot-com bubble by analyzing overvalued companies with little revenue or profitability. Top 6 Real Estate Investing Books for Beginnersīurry has stated that his investment style is built upon Benjamin Graham’s and David Dodd’s 1934 book “Security Analysis,” the core text for value investing, saying: “All my stock picking is 100% based on the concept of a margin of safety.15 Highest-Rated Crypto Books for Beginners.10 Best Stock Trading Books for Beginners.How to Buy Stocks? Complete Beginner’s Guide.15 Top-Rated Investment Books of All Time.What is Investing? Putting Money to Work.Recommended video: Michael Burry explains how he shorted the housing bubble And though he was exceptionally brilliant, Burry had few friends and was not yet established in investment circles when he embarked on his career. Michael Burry was always awkward and anti-social, leading him to later self-diagnose himself with Asperger’s syndrome. Soon, without finishing, he left school to start his hedge fund, which he called Scion Capital. After moving back to California to do his residency at Stanford, Burry would dabble in financial investing on nights off duty. He studied economics and pre-med at UCLA and earned his medical degree at Vanderbilt University School of Medicine in Tennessee. Who Started Bitcoin? The True Story of Satoshi Nakamoto

Who is Robert Kiyosaki? The Story of “Rich Dad Poor Dad” Who is Jordan Belfort? True Story of “The Wolf of Wall Street” Who is Bernie Madoff? History’s Largest Ponzi Scheme Explained Any testimonials contained in this communication may not be representative of the experience of other eToro customers and such testimonials are not guarantees of future performance or success. Finbold is compensated if you access certain of the products or services offered by eToro USA LLC and/or eToro USA Securities Inc.

0 kommentar(er)

0 kommentar(er)